Solutions for Optimizing Crypto Investment Strategies

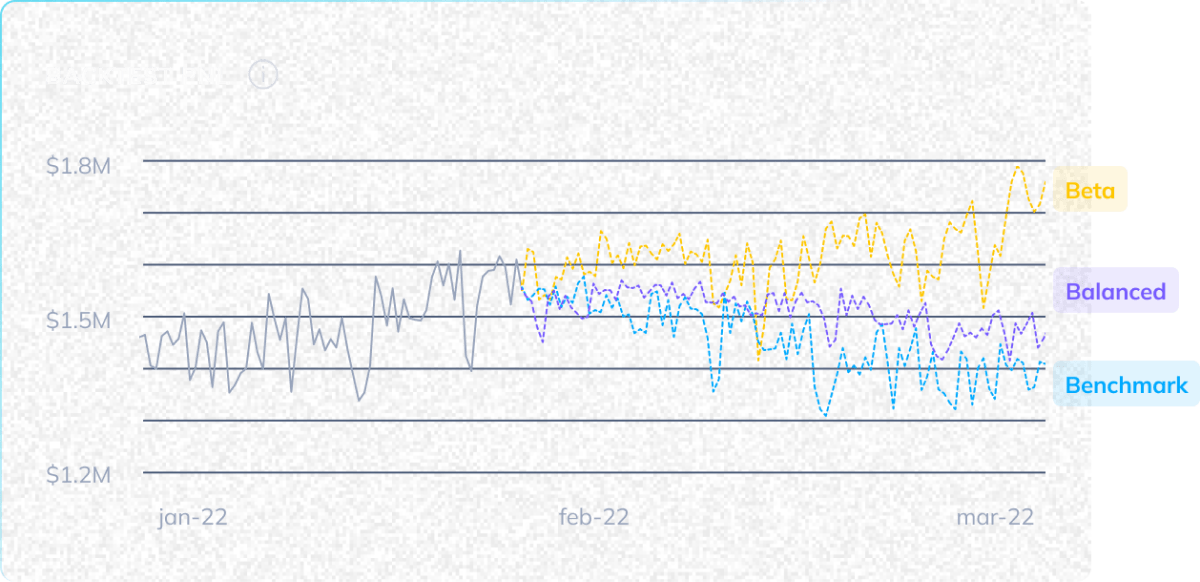

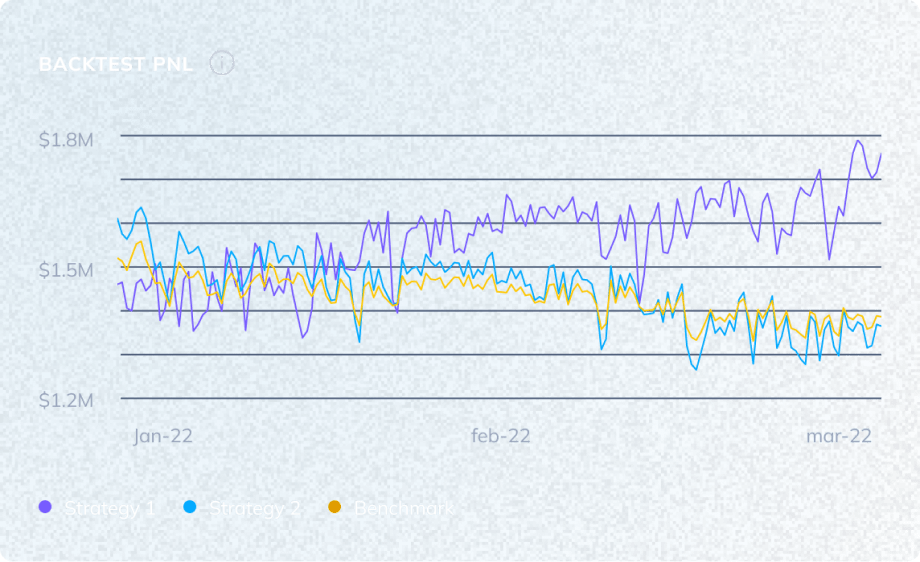

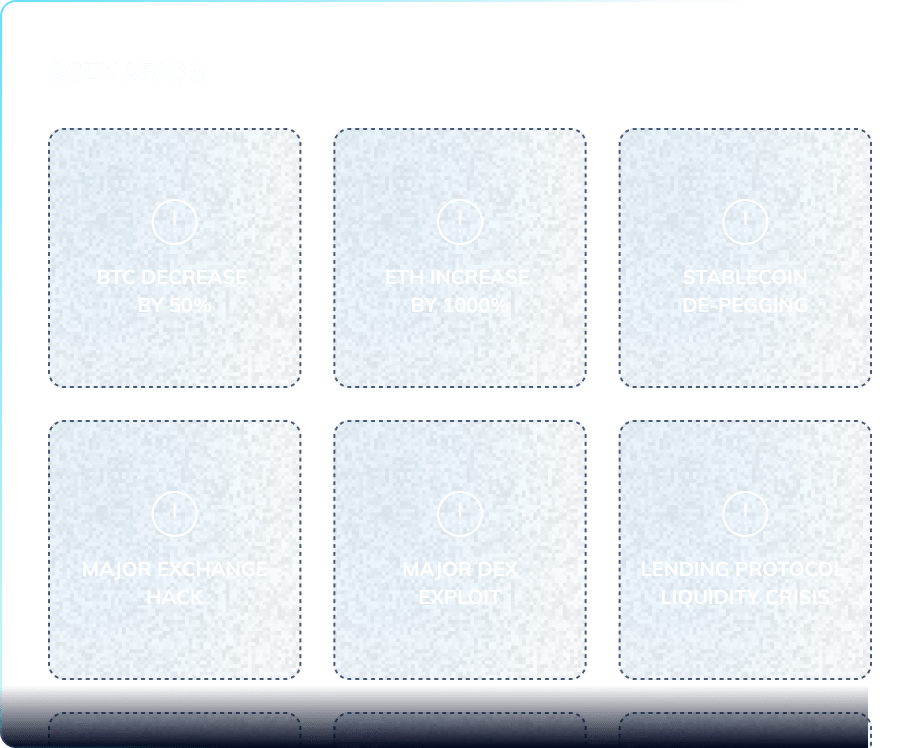

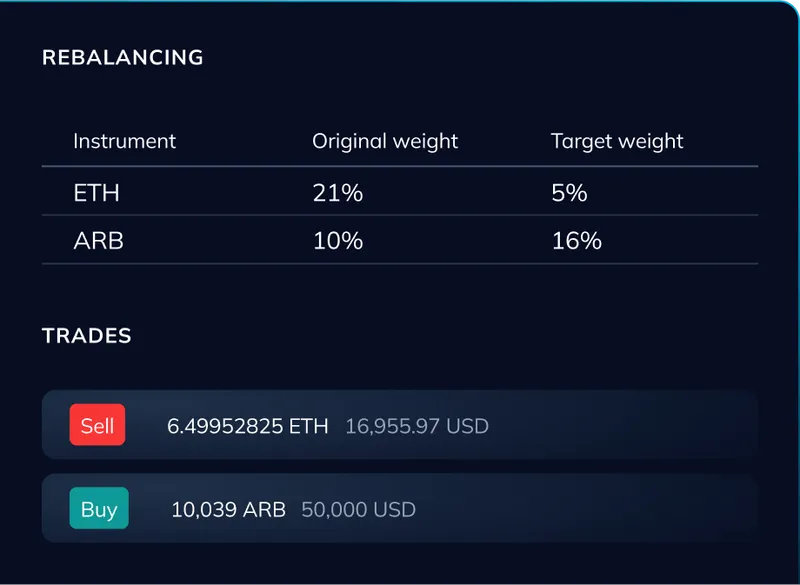

With so many scenarios to consider, calculations to make, and parameters to check, crafting a strategy in such a volatile market is a complex task where reducing uncertainties is crucial. Nuant streamlines this process with AI-driven tools developed by experienced engineers and quants, making it both manageable and effortless.